The major and often largest value assets of most companies are that company’s machinery, buildings, and property. It will always be true as long as all transactions are appropriately accounted for and can never fail or be out of balance for any given entity. It can also cause problems with taxes and audits, as well as customers who may suspect fraud or mishandling of funds as a result of an unbalanced equation. This formula represents marginal tax rate definition the accounting identity, which must always be true for all entities regardless of their business activity. And we find that the numbers balance, meaning Apple accurately reported its transactions and its double-entry system is working. This arrangement can be ideal for sole proprietorships (usually unincorporated businesses owned by one person) in which there is no legal distinction between the owner and the business.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. On 22 January, Sam Enterprises pays $9,500 cash to creditors and receives a cash discount of $500.

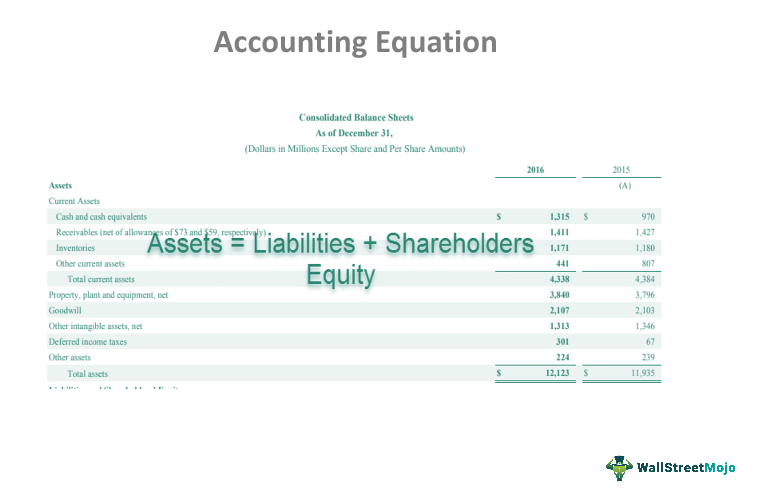

These are the resources that the company has to use in the future like cash, accounts receivable, equipment, and land. The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system. The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is based on the idea that each transaction has an equal effect.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use.

Incorrect classification of an expense does not affect the accounting equation. Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off. An asset is a resource that is owned or controlled by the company to be used for future benefits.

To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business. Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity. The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left-side value of the equation will always match the right-side value. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity. Equity refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted.

The accounting equation equates a company’s assets to its liabilities and equity. This shows all company assets are acquired by either debt or equity financing. For example, when a company is started, its assets are first purchased with either cash the company received from loans or cash the company received from investors. Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity. The income and retained earnings of the accounting equation is also an essential component in computing, understanding, and analyzing a firm’s income statement. This statement reflects profits and losses that are themselves determined by the calculations that make up the basic accounting equation.

In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity. The accounting equation is not always accurate if it is unbalanced. This can lead to inaccurate reporting of financial statements and incorrect decisions made by management regarding money and investment opportunities. To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Refer to the chart of accounts illustrated in the previous section.

This equation is behind debits, credits, and journal entries. This number is the sum of total earnings that were not paid to shareholders as dividends. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities. Equity includes any money that has been invested into the company by shareholders as well as retained earnings which have not yet been paid to shareholders as dividends.

This is what ensures that every transaction makes sense and there will always be an entry on both sides of each transaction. This arrangement is used to highlight the creditors instead of the owners. So, if a creditor or lender wants to highlight the owner’s equity, this version helps paint a clearer picture if all assets are sold, and the funds are used to settle debts first. A lender will better understand if enough assets cover the potential debt. The accounting equation is so fundamental to accounting that it’s often the first concept taught in entry-level courses.

While single-entry accounting can help you kickstart your bookkeeping knowledge, it’s a dated process that many other business owners, investors, and banks won’t rely on. That’s why you’re better off starting with double-entry bookkeeping, even if you don’t do much reporting beyond a standard profit and loss statement. Taking time to learn the accounting equation and to recognise the dual aspect of every transaction will help you to understand the fundamentals of accounting.